What is EzyChart?Full-featured stock market charting software built for private investors & traders wanting to chart at home or on the go. It offers multiple chart styles & drawing tools, interactive mouse cursors & over 50 technical analysis indicators.

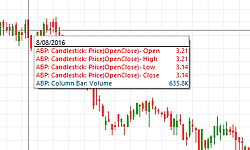

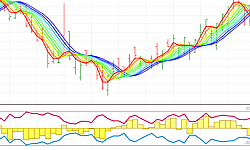

Interactive CursorsSwitch between interactive mouse cursors to gain different insight into your charts. Use either the Cross Hair, Statistics or Mouse Zoom pointers and more.Financial Chart StylesSelect from Bar, Candlestick, Line, Equivolume, Gann Swing, Point & Figure, Renko and Kagi. You can also open charts as Japanese Candle, Elder Ray, Mountain, HLC (High-Low-Close) and Rainbow Oscillator.Guppy, Berg and Hull IndicatorsEzyChart includes quick-access indicators and tools from three top industry experts:Daryl Guppy - Guppy Multiple Moving Average (GMMA) and Modern Darvas box. Stop-loss drawing tools: Count back line (CBL) Short, CBL Long, CBL Short Stop, CBL Long Stop and the Average True Range (ATR) Short & ATR Long Jim Berg - Volatility Price, Volatility Profit Taker and Volatility Trailing Stop. Alan Hull - Hull Moving Average, Hull Multiple Moving Average, Rate of Annual Return and Range indicator. Watch below as Alan Hull discusses his indicators for trend trading in EzyChart.  html video code by VideoLightBox.com v3.1 html video code by VideoLightBox.com v3.1

|

Choosing the Best Charting SoftwareIdeal for ASX charting as well as worldwide exchanges; EzyChart is trusted Australian charting software recommended by Australian experts. It has a customisable workspace and lets stock market investors & traders tweak indicator parameters to suit their strategy.

Technical Analysis IndicatorsEzyChart's wide selection of indicators can be overlayed on a chart or opened in their own panel. Customisable in style and function, you can alter their parameters to apply your trading strategy i.e. change a simple 20-day moving average on close price to a 30-day exponential on open price - or any other combination.CustomisableMake changes to the style and organisation of your stock market charts. Modify colours and shadings for indicators, drawing tools and the up-and-down colour rule of the chart type.Money ManagementEzyChart is unique share market charting software in that it contains money management tools. You can place a 'Stop Loss' on your charts using either % method, Average True Range or Count Back. Or apply 'Stop Loss' strategies from Daryl Guppy's book Trading Tactics. All automatically recalculate as new data is applied to the chart.

|

How it WorksEzyChart is installed onto your Windows computer or laptop so your charts are always accessible, even when offline. The share charting software works best with Bodhi data so you can analyse price & fundamental info when charting the ASX.

Share Price & Fundamental DataEzyChart specialises in ASX stock charting software, displaying fundamentals for Australian Stock Exchange companies in a configurable window called the 'Stock List' (available only with Bodhi data).Watch below for more on this feature:  html video code by VideoLightBox.com v3.1 html video code by VideoLightBox.com v3.1

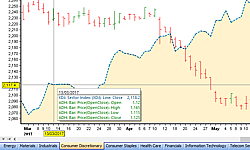

Sector ChartsASX Sector or Industry Group charts are automatically grouped under their headings with the relevant sector index overlayed. For instance, you can scroll all equities in the Energy & Health or any other Sector.Easy Video TutorialsThrough our YouTube channel and online Help, watch short tutorials and walk-through's on using EzyChart. |

TRUSTED NAME IN HOME-BASED CHARTING SOFTWARE FOR OVER 30 YEARS

FOR A CLEARER

MARKET OUTLOOK

MARKET OUTLOOK

EzyChart - Technical Analysis Indicators x

| Icon | Indicator | Description |

|---|---|---|

| EzyChart - Indicators & Oscillators | Copyright © 2006 - | JustData | ||

| Accumulation Swing (ASI) | The Accumulation Swing Index is a cumulative total of the Swing Index developed by J. Welles Wilder. | |

| Average True Range (ATR) | The Average True Range is a volatility indicator created by J. Welles Wilder (who also designed the DMI & RSI) used to measure the commitment (noise) in the market. | |

| Berg Volatility Price (BVP) | The Berg Volatility Price indicator was created by Jim Berg. Jim uses well-known volatility indicators such as Average True Range and Relative Strength with his own formulas to identify when to enter and exit trades to make a reasonable profit. | |

| Berg Volatility Profit Taker (BVPT) | The Berg Volatility Profit Taker was created by Jim Berg. It is used to identify when a security has accelerated too fast and far and has created a profit taking opportunity. It combines a moving average of high or low prices with the average true range. | |

| Berg Volatility Trailing Stop | The Berg Volatility Trailing Stop was created by Jim Berg. Jim uses well-known volatility indicators such as Average True Range and Relative Strength with his own formulas to identify when to enter and exit trades to make a reasonable profit. | |

| Bollinger Bands (BB) | The Bollinger Bands principles were developed by John Bollinger in 1989. Bollinger bands are similar to Trading Bands except they vary in distance from a standard moving average line. | |

| Commodity Channel Index (CCI) | The Commodity Channel was developed by Donald Lambert in the early 1980's to identify cyclical turns in commodities. The CCI measures the variation of a security's price from its statistical mean. Low values show that prices are unusually low compared to the average whereas high values show the opposite. | |

| Coppock Oscillator (CO) | The Coppock Oscillator was created by economist, Edwin Coppock as a means of identifying the commencement of bull markets. It adds together the 14-month and 11-month percentage changes of price and then takes a 10-month weighted total of this figure to create the oscillator. | |

| Darvas Box (DB) | The Darvas Box indicator is based on Nicolas Darvas' "Darvas Box Theory". It uses a series of "states" to determine the upper and lower lines of a box by finding highs and lows. | |

| Darvas Box - Modern | The Modern Darvas Box is based on Nicolas Darvas' "Darvas Box Theory". The modern application uses the closing price as the trigger point for a stop loss exit. | |

| Directional Movement (DM) | The Directional Movement Indicator is a system developed by J. Welles Wilder. The system attempts to measure the strength of a price movement in positive and negative directions, as well as the overall strength of the trend. | |

| Elder Ray (ER) | The Elder Ray indicator was created in 1989 by Dr. Alexander Elder to measure the buying and selling pressure in the market. The indicator includes a Bull and Bear formula. | |

| Exchange Index | The Exchange Index represents the primary or secondary index (or National index) of the exchange that your current stock is traded on. For example, the primary and secondary indexes for ASX stocks are the All Ordinaries & S&P/ASX 200. | |

| Force Index | The Force index uses a moving average calculation to smooth the Force Price formula which was developed by Dr Alexander Elder. It combines price and volume to measure the strength of bulls and bears in the market. | |

| Force Price Line | The Force price was developed by Dr Alexander Elder and it combines price and volume to measure the strength of bulls and bears in the market. | |

| Gann Swing | The Gann Swing indicator was originally designed by W.D. Gann. It traces directional swings in the market based on the directions of highs versus lows over a trading range. | |

| Guppy Multiple Moving Average (GMMA) | The Guppy Multiple Moving Average was developed by Daryl Guppy and consists of two groups of fast and slow moving averages. | |

| Heikin Ashi | The Heikin Ashi was created from Japanese candlesticks but instead of using actual trading prices it calculates its own by averaging a group of prices from the current and previous bars. It is extremely useful for identifying trends and spotting buying opportunities easily. | |

| Hull Moving Average (HMA) | The Hull Moving Average was developed by Alan Hull as a means to make a moving average more responsive to the current price activity, eliminating lag. | |

| Hull Multiple Moving Average (HMMA) | The Hull Multiple Moving Average was developed by Alan Hull. It is a series of lines that track and filter price movements. The HMMA consist of 2 sets of lines that allow the user to observe and compare the immediate behaviour of price activity with the long-term behaviour of the price activity. | |

| Hull Range Indicator | Developed by Alan Hull, it consists of three lines which break a chart into 4-zones. The lines include a linear regression line known as the Central Cord, which is enveloped by an Upper and Lower Deviation line which captures the bulk of price activity. The Deviation lines are calculated using the Average True Range. | |

| Hull Rate of Annual Return (HRoR) | The Hull Rate of Annual Return was developed by Alan Hull and is used to calculate the annual rate of return of a share given its current rate of climb or fall. It achieves this by calculating the annual increase in price activity and then dividing it by the current share price. | |

| Industry Index | The Industry Index represents the industry group your current security is classified in. For example, if your current security is ANZ from the Australian Securities Exchange, the Banks Index will be overlayed when you select Industry Index. | |

| Jason's Indicator Convergence Divergence (JICD%) | Created by Jason Mitchell the JICD% is a basic trend/rally following indicator originally designed to help improve and locate entry points into new intermediate term trends. | |

| Linear Regression | The Linear Regression indicator is a statistical tool used for identifying the strength and direction of a dominant market trend. | |

| Linear Regression Slope | The Linear Regression Slope is simply the slope of the Linear Regression line which shows you how quickly a security is moving up or down. | |

| Moving Average Convergence Divergence (MACD) | The MACD is a momentum oscillator originally designed by Gerard Appel. It calculates the difference between a fast and slow Exponential Moving Average (EMA) and oscillates above and below a centre (zero) line. | |

| MACD Histogram | The MACD Histogram is an oscillator developed by Thomas Aspray to anticipate crossover signals between the MACD and the signal line. | |

| Median Price Line | The Median price is the value half-way between the High and Low prices on a bar. This price is used mainly for finding patterns in candlestick charts. | |

| Mid Price Line | The Mid price is the value half-way between the Open and Close prices on a bar. This price is used mainly for finding patterns in candlestick charts. | |

| Momentum Oscillator | The Momentum Oscillator shows the relationship between today's price and the price of x bars ago. It is displayed as a ratio. | |

| Money Flow Index | The Money Flow Index was created by Gene Quong and Avrum Soudack and it attempts to measure the strength of money flowing in and out of a security. | |

| Moving Average (Simple; Weighted & Exponential) | A moving average shows the average value of a security's price over a set period. It is used to emphasise the direction of a trend and to smooth out price and volume fluctuations that can confuse interpretation. | |

| On Balance Volume | The On Balance Volume is a mathematical formula created by Joe Granville. It is a trend-following accumulation indicator that works on the premise that volume has a strong tendency to lead price. | |

| Parabolic SAR | The Parabolic Stop and Reverse is a trend indicator that was developed by J. Welles-Wilder. It calculates trailing stops and breakout points. | |

| Percent Price and Volume | The Percent Price and Volume is very similar to the On Balance Volume indicator. The main difference is the way in which the volume for each days trade is accumulated. | |

| Pivot Point Price Line | The Pivot Point is a calculation using the average of the high, low and close prices of the previous bar. | |

| Price and Volume Trend (PVT) | Price and Volume Trend is a technical analysis indicator intended to relate price and volume in the stock market. PVT is based on a running total volume, with volume added according to the percentage change in closing price over the previous close. | |

| Price Lines - Open, High, Low, Close, Open Interest & Sales | These a six individual lines that independently graph the open, high, low, close, open interest and sales amount. | |

| Price Oscillator | The Price Oscillator is a momentum indicator that compares the value of a short and long-term moving average. It consists of a price line; signal line, percentage line and histogram line. | |

| Rainbow Averages | The Rainbow Averages were developed by Mel Widner, Ph.D. It is a trend following indicator that applies ten moving averages to your chart in a recursive smoothing process (each new average is based on the previous average). | |

| Rainbow Band | The Rainbow Band measures the bandwidth of the Rainbow Oscillator. Bandwidth is determined directly from the averages and is the normalised range of the averages at a particular time. | |

| Rainbow Oscillator | The Rainbow Oscillator is a trend-following indicator based on the Rainbow Averages calculations. It uses the difference between the highest high and lowest low price to relate difference between the current price and the average of the rainbow, creating an oscillator (histogram) which moves above and below a zero level. | |

| Rate of Change | The Rate of Change indicator shows the relationship between the change in price over x periods and the closing price of x periods ago. It is displayed as a percentage which oscillates above or below a centre (zero) line of equilibrium as it moves from positive to negative. | |

| Relative Strength Index (RSI) | The Relative Strength Index was developed by J. Welles-Wilder, it compares the average price change of the advancing periods with the average change of the declining periods. | |

| Relative Strength Ratio Index (RSRI) | The RSRI compares the performance of a security to that of a market average (index). | |

| Sector Index | The Sector Index represents the sector your current security is classified in. For example, if your current security is BHP from the Australian Securities Exchange, the Materials Index will be overlayed when you select Sector Index. | |

| Stochastic Oscillator | The Stochastic Oscillator is a momentum oscillator developed by George C. Lane. It's designed to show the 'close' relative to the 'high-low range' over a set number of bars. | |

| Stop-Loss (Count Back, Percentage & Average True Range) | Stop-Loss is a figure determined by an investor that when reached, means you will sell a security preventing a small loss from becoming a large loss. This figure can be produced by a calculation, percentage, or personal preference to take the emotional aspect out of trading. | |

| Support & Resistance Levels | The Support & Resistance represent key junctures where the forces of supply and demand meet. As demand (buying) increases the prices advance and when supply (selling) increases, prices decline. | |

| Support & Resistance Lines | The Support & Resistance Lines indicator produces multiple support and resistance lines for a range of bars. The size of the range is defined by as a bar count and is user configurable. | |

| Swing Index | The Swing Index was developed by J. Welles Wilder, it tries to mathematically determine a fair average price for a security by comparing the relationship between the prices of today and yesterday (or last 2-bars). | |

| Trading Bands | Trading Bands comprise of three parallel moving average lines. The first is a standard moving average plotted centrally. The second moving average is shifted vertically up by a set percentage while the third is shifted vertically down by a set percentage. | |

| True Range Price Line | The True Range line is a calculation using the high, low and close prices of the current bar. | |

| Typical Price Line | The Typical price line is a calculation using the average of the high, low and close prices of the current bar. | |

| Volume Bar chart | Volume is the total amount of securities sold during the period when a security was trading. | |

| Volume Weighted Average Price (VWAP) | The Volume Weighted Average Price line is the sum of the number of shares bought multiplied by the price paid for it then divided by the volume. The calculation starts when trading opens and ends when it closes. | |

| Weighted Price Line | The Weighted price line is a calculation using the, high, low and close prices of the current bar giving extra weight to the close price to hopefully reduce noise in the market. | |

| Williams %R | The Williams %R is a momentum indicator developed by Larry Williams that measures overbought and oversold levels. | |

| Zig Zag | The Zig Zag is calculated by plotting points on the chart when prices [Price] reverse by at least the specified amount [Variance]. Lines are then drawn between these points to create the Zig Zag. | |

| Copyright © Electronic Information Solutions Pty Ltd 1990 - . All Rights Reserved. |